The 7-Minute Rule for Worker's Compensation

Wiki Article

Some Ideas on Worker's Compensation You Should Know

Table of ContentsHow Worker's Compensation can Save You Time, Stress, and Money.Top Guidelines Of Worker's CompensationWorker's Compensation for DummiesExamine This Report on Worker's CompensationThe 5-Minute Rule for Worker's CompensationNot known Factual Statements About Worker's Compensation Everything about Worker's Compensation

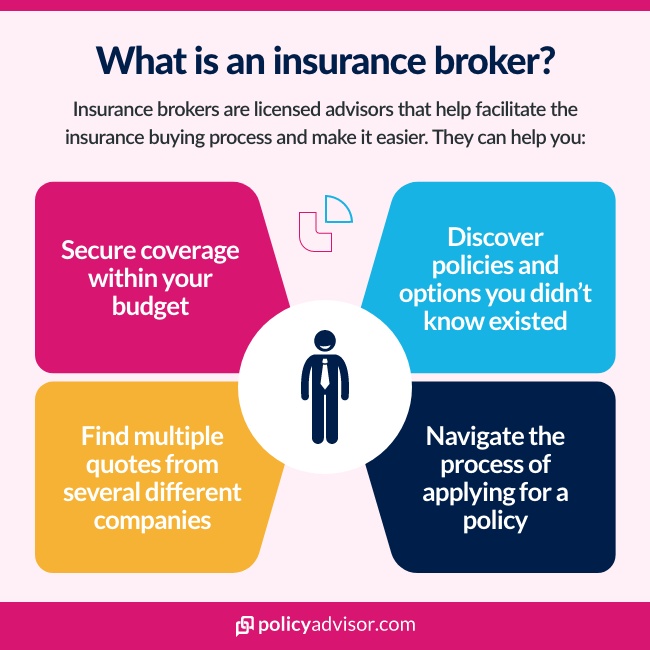

They have accessibility to several products, supplied by different firms. A broker needs to additionally be able to obtain quotes from at least 3 insurance companies in order to offer varied contracts to their clients. The occupation of insurance coverage broker basically is composed in. They deal with customers, using them a selection of insurance policy products to fit their requirements, An insurance policy broker is paid by insurers when they discover them brand-new clients.Below are some advantages of using an insurance broker. One of their major jobs is to compare the different products provided by the business to which they have gain access to.

The broker's after that allow them to select from amongst the many existing insurance coverage items that supply the for their clients. With access to a range of insurance products, an insurance coverage broker can aid you find the plan that best fits your demands as well as budget. They will certainly initially analyze your circumstance and after that, after, pick numerous contracts.

9 Simple Techniques For Worker's Compensation

Brokers have than a routine client. The insurance policy company has every rate of interest in coming to an agreement with the broker if it wants to proceed its partnership.

The Ultimate Guide To Worker's Compensation

When an insurance coverage firm has an excess of funds from premiums, it will safely spend this cash to generate income. What is the distinction between an insurance coverage business and a firm? What concerning an insurer and a broker? Merely, representatives and brokers in insurance coverage are middlemans between business and also customers.Insurance provider are carriers of the item, while agencies are carriers of the service, dispersing the item to consumers. What are the advantages and disadvantages of an insurance coverage business? The following is among one of the most significant pros of selecting an insurance provider as your company: Direct supplier: An insurance firm is the service provider of an insurance plan.

The cons of choosing an insurance provider as your supplier include: Impersonal solution: You won't receive the individualized solution from an insurer that you can receive from a representative or broker. If you wish to work with a person who takes your one-of-a-kind demands into factor to consider, you might wish to collaborate with an agent or broker instead.

Some Of Worker's Compensation

What is the difference in between an insurance coverage broker and a representative? While both representatives as well as brokers deal with insurer and also insurance coverage customers, they differ in that they represent during the acquiring procedure. An insurance coverage representative stands for each of the insurance coverage service providers they deal with, while an insurance coverage broker stands for the insurance customer - Worker's Compensation.

Better policy choices: When you function with an independent agent, they can compare various insurance provider to locate you the most effective plan. No charge: You don't have to pay a hourly cost or a consulting fee to deal with an insurance agent. You'll likewise pay the very same price whether you purchase your policy with an insurance policy representative or directly from the insurance provider.

Little Known Questions About Worker's Compensation.

While a representative stands for insurer, brokers represent the consumers. Because brokers don't represent business, they can provide honest suggestions to their clients. What are the pros and cons of an insurance broker? The pros of picking a broker as your insurance policy service provider are that they: Act in the client's ideal passion: Service from a broker is personalized and also sincere.Quality differs per broker agent firm: Not every insurance broker supplies the very same quality of service, so you may wish to go shopping about before picking to collaborate with a brokerage. Bear in mind the pros and disadvantages of working with an insurance broker when picking an insurance coverage supplier. Gunn-Mowery offers the very best of both worlds as both an insurance coverage company and an insurance policy broker.

Insurance Brokers see it here must have a deep understanding of the insurance policy market to do their task successfully as well as keep up to date on brand-new strategies and promotions, which they will frequently receive information regarding from insurance firms. Various other tasks usually include conference as well as speaking with new clients, calling Insurance Insurance adjusters and medical examiners when required, and visit this page also speaking to clients and also insurance coverage firms relating to repayment concerns.

Things about Worker's Compensation

Join our An And Also Insurance policy Family and also allow us do the buying for you Insurance coverage brokers are accredited specialists (certified according to state laws) and also exist to help make your insurance coverage purchasing much easier. You can consider them as clearinghouses for all theinfo you require to take into consideration when it comes to finding the very best offers on auto insurance or a home owner's policy.An insurance policy agent is a certified professional that sells insurance policies straight to the consumer on part of one or even more insurance companies. An insurance broker represents the clients.

There are insurance brokers for residence, vehicle, health as well as life insurance coverage. An insurance policy broker represents insurance policy customers, not insurer. A broker remains in organization by accumulating commissions on insurance coverage sales, and the you can find out more task of a broker is to discover budget friendly prices on policies for drivers and also homeowners. They're specialists in insurance policy coverage, and your friendly broker is proficient in helping you decide what the most effective insurance coverage choices are for your special circumstances.

What Does Worker's Compensation Mean?

Another benefit of going to a broker for insurance is that it's a low pressure experience. The broker has no motivation to market you on one certain plan and is flexible when it pertains to aiding find insurance coverage at a rate you can afford. You can obtain a quote for the very same protection from several different insurance firms and also, due to the fact that it's an affordable setting, there's a reward for insurance firms to supply cheap prices and affordable coverage choices.Report this wiki page